Binance has established itself as one of the world’s leading cryptocurrency exchanges, renowned for its extensive range of trading options and robust platform infrastructure. Understanding Binance’s core trading operations requires a comprehensive look at how the exchange facilitates buying, selling, and exchanging digital assets while ensuring security, liquidity, and user accessibility.

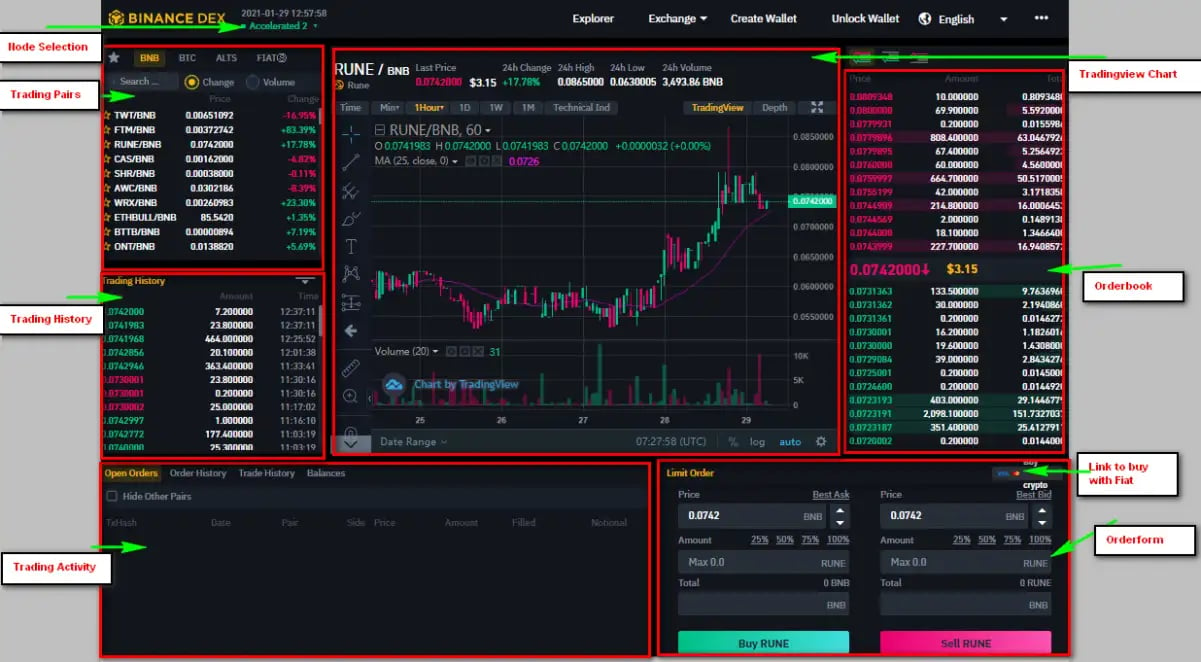

At the heart of Binance’s operations is its spot trading platform. Spot trading involves the immediate purchase or sale of cryptocurrencies at current market prices. Users can trade a wide variety of digital assets against fiat currencies or other cryptocurrencies. The platform supports numerous trading pairs, allowing traders to diversify their portfolios efficiently. The interface is designed to cater both to beginners with simple order types like market and limit orders and to advanced traders who utilize features such as stop-limit orders and OCO (One Cancels the Other) orders for more strategic executions.

Binance also offers futures trading, enabling users to speculate on the price movements of cryptocurrencies without owning the underlying asset. Futures contracts on Binance allow traders to leverage their positions significantly, amplifying potential gains but also increasing risk exposure. how this works in practice segment caters primarily to experienced traders who understand margin requirements and risk management strategies.

Liquidity provision is another critical aspect that underpins Binance’s core operations. The exchange aggregates liquidity from millions of users worldwide in real-time through an advanced matching engine capable of processing thousands of transactions per second with minimal latency. This ensures tight bid-ask spreads and efficient order execution even during periods of high volatility-a crucial factor in maintaining trader confidence.

Security measures are deeply integrated into Binance’s operational framework. Given the nature of digital assets and past industry incidents involving hacks, Binance employs multi-tiered security protocols including cold storage for most funds, two-factor authentication (2FA), withdrawal whitelist controls, anti-phishing codes, and continuous monitoring for suspicious activities. These efforts help protect user funds while maintaining compliance with global regulatory standards.

Furthermore, Binance enhances user experience by providing various tools such as real-time charts powered by TradingView integration, detailed order book data, historical trade records, API access for algorithmic trading bots, and educational resources aimed at improving trader knowledge.

In summary, understanding Binance’s core trading operations reveals a sophisticated ecosystem that balances technical innovation with user-centric design principles. By offering diverse products ranging from spot markets to leveraged futures alongside strong security practices and high liquidity levels, Binance continues to serve as a pivotal gateway for individuals seeking participation in the dynamic world of cryptocurrency trading.